By: Stratton Kirton, skirton@hamiltonps.com and Bryce Campanelli, bcampanelli@hamiltonps.com

Global and domestic oil markets are in chaos. Oil producers are pumping millions more barrels of oil each day than the market needs, and storage is running out. Oil futures dropped into the negative price range for the first time in history. Energy companies are reporting losses and, like other sectors of the economy, their workforce is suffering. And the debate about a federal response to help the industry through the turmoil is nascent.

So, how did we get here?

In early April, OPEC and a group of countries led by Russia agreed to cut production by nearly 10 million barrels of oil per day—the single largest cut in history—to help stabilize rapidly falling prices.

But despite the historic cuts, the price of oil has fallen by 40 percent since the cuts were announced. Overall, prices have fallen by two-thirds from the beginning of the year, and more than half of the U.S. fleet of drilling rigs are already idle.

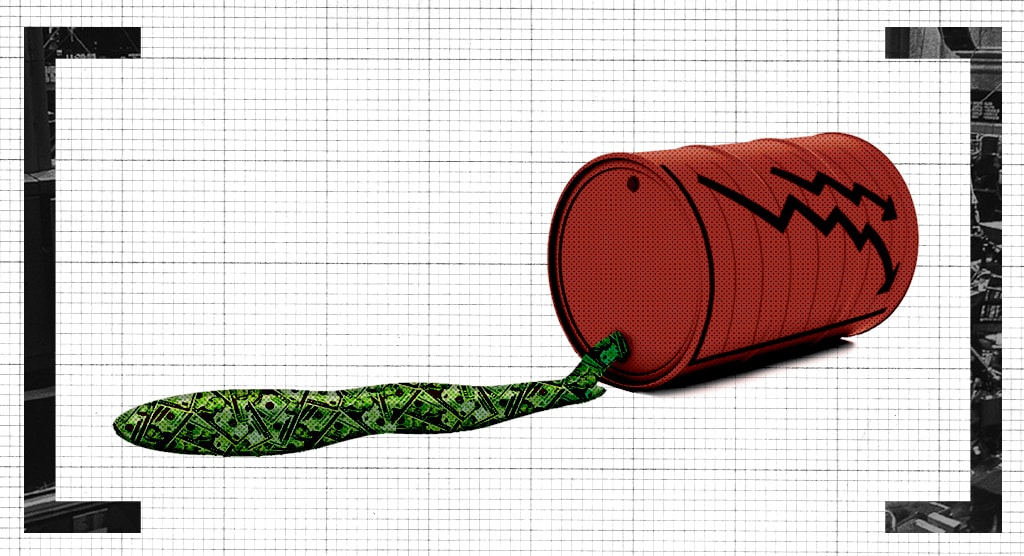

Until the COVID-19 crisis, the world consumed about 100 million barrels of oil per day. The OPEC cut represented a supply reduction of about 10 percent – at the time seen as a groundbreaking and unprecedented move to buoy prices. But because COVID-19 is a global pandemic, it has destroyed demand around the world almost overnight. Estimates are that demand for oil has plunged by 20 to 35 percent.

The situation is exacerbated by the fact that the oil market has been tight in recent years. In 2018 and 2019, there was less than one percent difference between production and consumption of oil. With demand so closely matching supply, there were strong market incentives for marginal, and often more expensive, oil wells to come online.

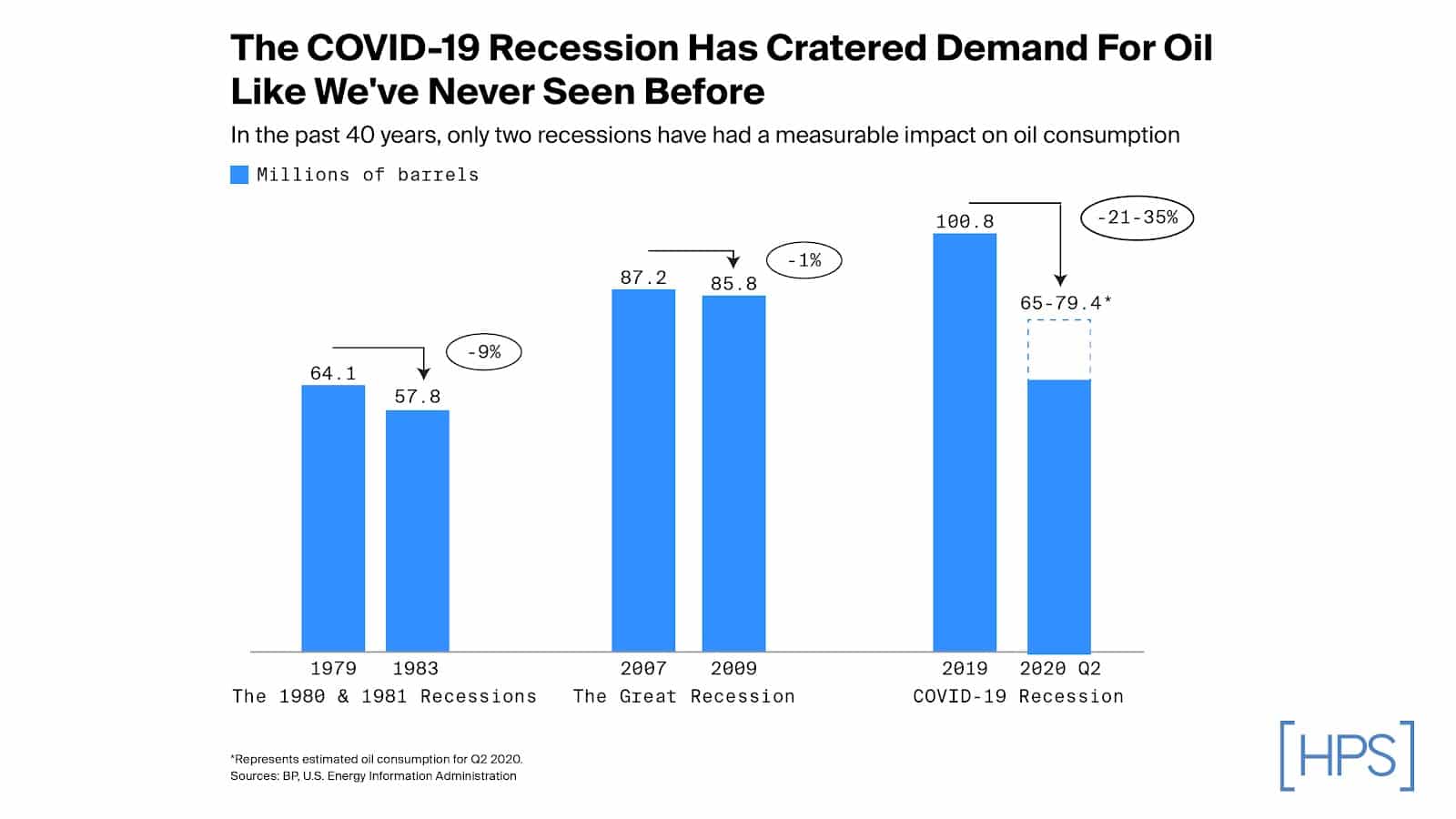

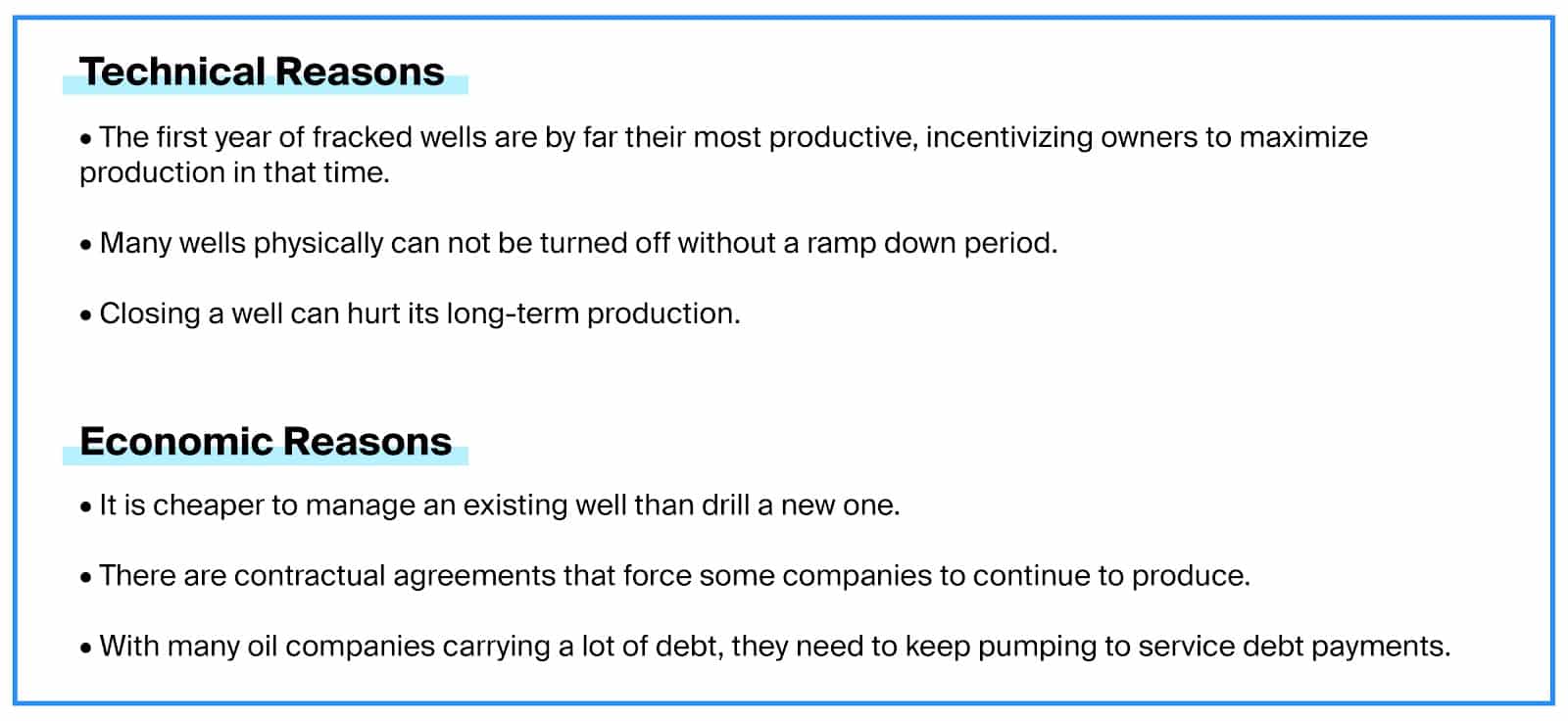

The industry is now faced with an oil market version of the “tragedy of the commons” – where production needs to be cut, but in many cases, producers are reluctant to cut their own production for a variety of technical and economic reasons.

So, what can be done?

Somewhere, production will have to be cut.

On OPEC.

These are countries highly dependent on oil exports for government revenues—oil going out the door at a low price is better than no oil going out at all. Add to that OPEC members’ history of agreeing to cuts but then not adhering to them (also known as cheating), and it all means we’ve probably seen as much action from OPEC to reduce supply as we can reasonably expect.

On the U.S.

There are simply very few formal levers to restrict current production. The federal government only has indirect actions it can take to slow production. At the state level, a few states have bodies that can regulate production. Texas, Oklahoma, and North Dakota all have meetings scheduled in May for their regulators to consider production caps—but it is far from certain any of them will actually act.

So, what now?

Ultimately, only a realignment of supply and demand can truly solve the oil crisis. It won’t be pretty, and there will likely be difficulties along the way, but like so many other sectors of the economy—it all depends on how fast economies bounce back from COVID-19. If economic demand picks back up, so will demand for oil. Until then, we are likely to see more and more marginal producers squeezed out if we face a prolonged period of low prices.

What to watch for.

Will the federal government intervene?

When will we run out of storage?

Will states cap production?

What will happen in markets?

Will OPEC stick by their cuts?

[1]All prices referenced are West Texas Intermediate (WTI).

By: Bryce Campanelli, bcampanelli@hamiltonps.com and Mariel Messier, mmessier@hamiltonps.com

The long standing debate over compensating student athletes entered a new phase, with NCAA President Mark Emmert recently telling a congressional subcommittee that the association will detail “recommendations on compensation policy changes [for student-athletes] by January 2021 with a preview of early ideas to be released in April.” (Bloomberg) Congress and state legislators have been pursuing changes to the rules preventing payments to student-athletes since California upended college athletics with the first state law requiring student-athletes to be fairly compensated for the use of their name, image, and likeness (NIL).

By signing the Fair Pay to Play Act into law, the Governor of California set in motion a dynamic process that will play out over the coming years and ultimately decide how student-athletes across all divisions and sports are compensated for the use of their name, image, and likeness.

Over the past five months, the NCAA, state legislators, student-athlete advocates, and Congress have weighed in with initial reactions and desired outcomes of this debate. In October 2019, in a move that once seemed far-fetched, the NCAA Board of Governors voted unanimously to develop a NIL policy. A few weeks later, a bipartisan congressional group announced plans to investigate and make their own recommendations on a NIL policy.

While an ultimate decision on exactly how the NCAA will engage around fair compensation remains a few months off, over the next several months, the landscape for this discussion will be shaped by social, political, and media dynamics. Indeed, it already is.

To better understand the evolving narrative surrounding NIL, the prevalence of state and national policies, and the voices driving the conversation, HPS conducted an analysis of media coverage of over 6,500 news articles to determine the frequency and penetration of 117 key terms in relation to NIL policies. This approach offers an alternative to commonly-used sentiment analysis by delivering insights about how much an issue is discussed within an article and which messages are present—and to what extent—in media coverage.

Here’s what we found. Over the course of these decisions:

California has kicked off a national conversation about athletes’ rights and forced everyone to take action, moving beyond periodic discussions and into the realm of new governance policies. What remains to be seen is how the NCAA and policymakers will balance the benefits and advantages currently offered to student-athletes, including more than $3 billion annually in scholarships, with new economic realities spurred by technology, social networks, and our media culture. The smart position for the NCAA is to actively engage in these current discussions to develop a new framework for adequately compensating student athletes in the modern landscape.

NCAA Blog Post by Hamilton Place Strategies on Scribd

It will come as a shock to no one that 2016 was a year of disruptive political campaigns. That disruption was on continual display for all to see, but what many didn’t witness was the transformation taking place behind the scenes as campaigns around the country began to adopt peer-to-peer services from car rides to lodging.

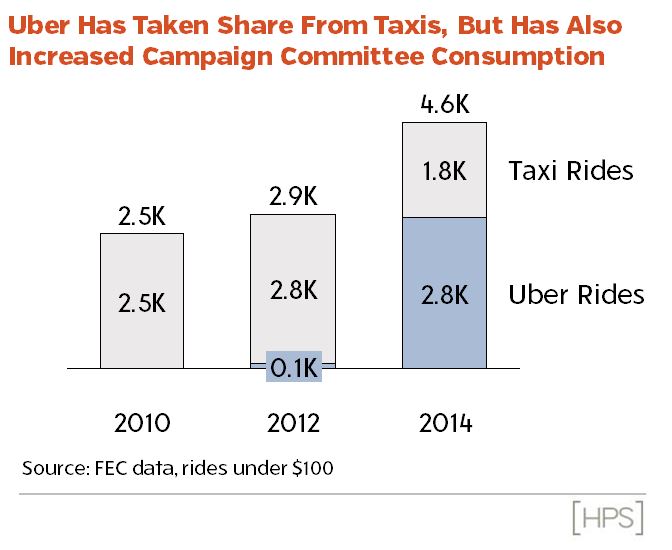

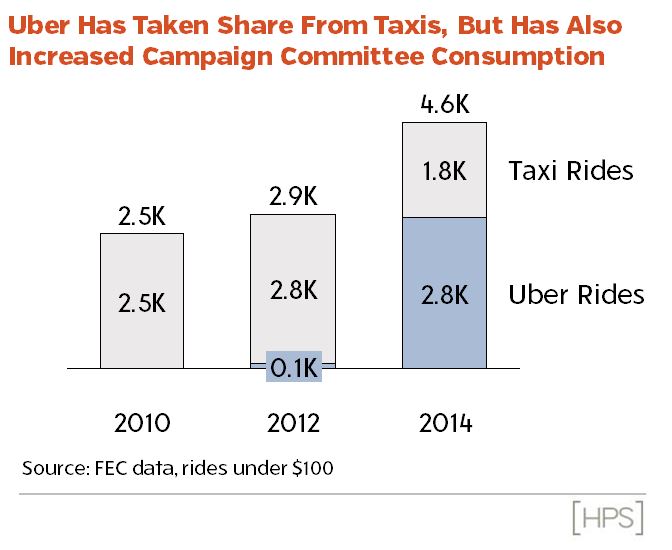

As a follow-up to our 2014 Uber study, we examined Federal Election Commission (FEC) data for both members of Congress and presidential candidates, and found that four peer-to-peer companies – ridesharing services Uber and Lyft and home sharing companies Airbnb and HomeAway – appeared on campaign expense filings for the 2016 election cycle. Ridesharing accounted for the majority of campaigns’ car travel expenses, and Lyft, Airbnb, and HomeAway all appeared on FEC reports for the first time during the election period.

Ridesharing adoption was the driving force behind the largest increase in congressional car service demand since 2010. Meanwhile, congressional campaigns spent more than $140,000 on Airbnb and HomeAway stays.

The 2016 presidential race exhibited similar trends, with ridesharing accounting for more than three-quarters of all candidate spending on car travel. General election rivals Donald Trump and Hillary Clinton together spent more than $65,000 on sharing economy companies, with Clinton spending more on ridesharing and Trump purchasing more short-term rentals.

Election 2016: The Rise Of The Sharing Economy by Hamilton Place Strategies on Scribd

In an era of 24-hour news, the confluence of commercial success and broader societal obligation is more intertwined than ever before. Shareholder and customer expectations are evolving and values-based leadership is becoming more prevalent.

Those realities make it difficult for companies to sustain success without a focus on its broader societal impact.

Some companies do so through a corporate social responsibility (CSR) program, while others follow a shared value (CSV) model. However, an emerging trend we define as CO/RE allows companies to maximize societal impact efforts and become policy leaders without looking too far beyond what they already do best.

This HPS paper explores ways three companies – JPMorgan Chase & Co., Toyota, and Zurich – have benefited from adopting a CO/RE approach. Key takeaways include:

HPS has released a report analyzing the regulatory and market implications of the drastic increase in Uber use by Members of Congress. Given that this trend is likely occurring at the local level as well, the key political question is – What does it mean for peer-to-peer companies when their regulators are also their committed customers?

Key findings are:

For low dollar rides during recent Congressional campaigns, Uber has overtaken taxis in both number of rides and amount spent.

The overall market demand for rider services during campaigns has increased since Uber launched.

Tom Kise, Director, Hamilton Place Strategies