Economic Sentiment Steady After Turbulent Two Weeks

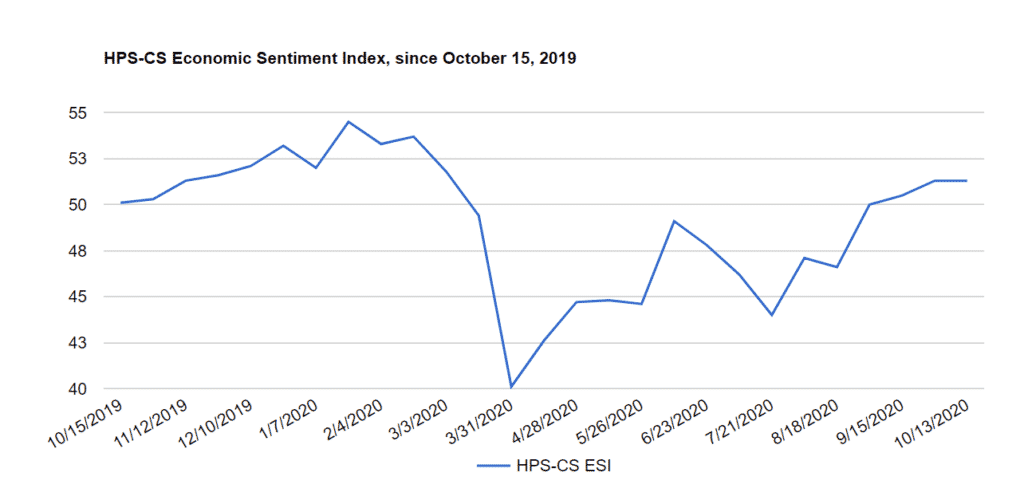

Overall economic sentiment held steady over the course of a turbulent early October. After a two-week stretch during which the President contracted COVID-19, the odds of a Democratic electoral sweep grew, and the prospects of renewed economic stimulus were revived, the HPS-CivicScience Economic Sentiment Index (ESI) hung on at 51.5.

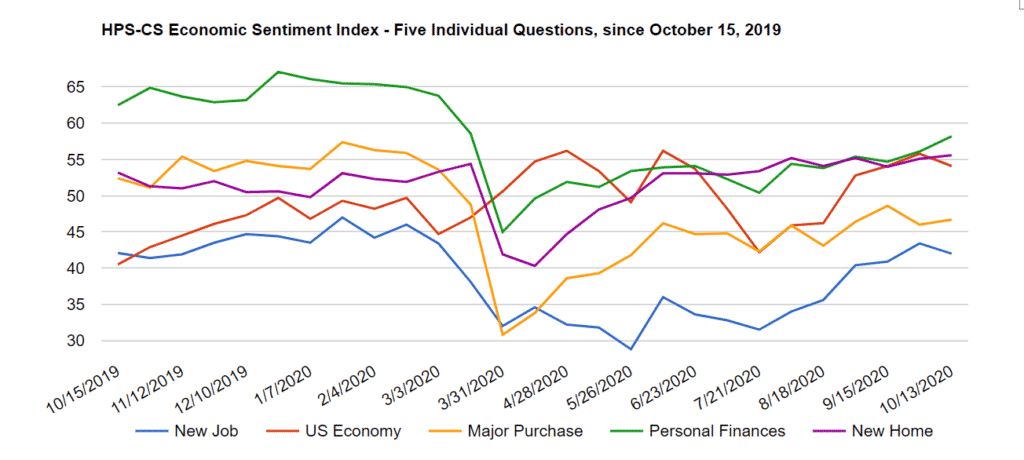

Though overall economic sentiment posted no changes over the past two weeks, the ESI’s five indicators did make moves. Making the biggest gain was confidence in personal finances, which rose 2.1 points to 58.2. Also rising were confidence in making a major purchase (up 0.7 points to 46.7) and confidence in the housing market (up 0.5 points to 55.6). Weighing these improvements down were decreases in the ESI’s remaining two indicators: confidence in the overall US economy declined 1.7 points, to 54.1, while confidence in finding a new job dropped 1.4 points, to 42.0. The latest reading marks the first time these two indicators have dropped since early July.

Politics dominated the headlines over the two-week period, notably the news that President Trump contracted, and was subsequently hospitalized for, COVID-19. The period also saw the President’s Democratic challenger, Joe Biden, build out his national and swing-state lead in the polls, with heightened expectations for a Democratic sweep of the presidency and both houses of Congress. In a move that may have a direct impact on Americans’ wallets, the President reversed course and endorsed another round of economic stimulus including $1,200 checks. Heightened expectations for stimulus pushed stocks to their best week since July.

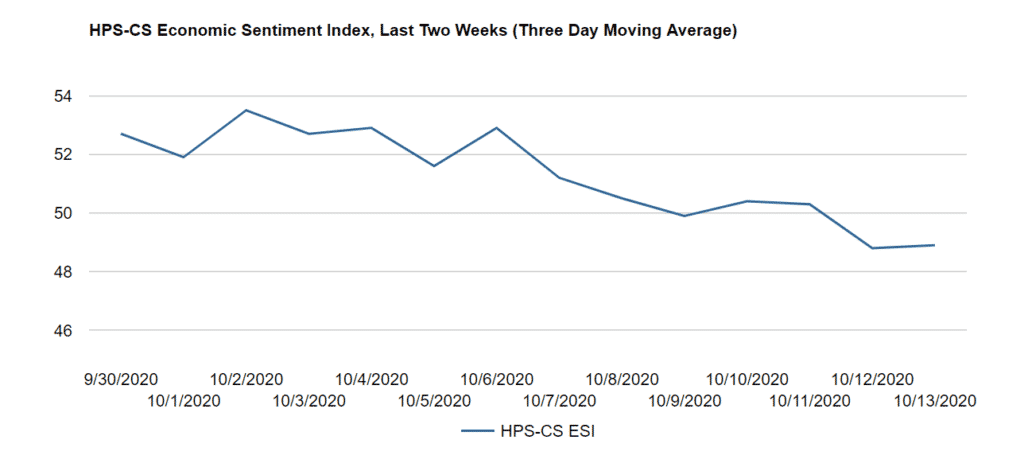

The ESI’s three-day moving average began the two-week stretch at 52.7, rising to its two-week high of 53.5 on October 2, before beginning a gradual decline. The moving average spiked briefly on October 6—the day the President signaled his support for a new round of economic stimulus—before falling to its two-week low of 48.8 on October 12, and then closing out the two-week stretch at 48.9.

About the Index

The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures. For a more detailed overview of the Index and the underlying methodology, please request a white paper.

About CivicScience

CivicScience, Inc. provides the leading intelligent polling and real-time consumer insights platform, the InsightStore™. Its proprietary platform powers the world’s opinions and quickly gets that data to the decision makers who care. Every day, CivicScience polls ask millions of people questions related to thousands of topics, while its powerful data science and big data technology analyzes current consumer opinions, discovers trends as they start, and accurately predicts future behaviors and market outcomes. CivicScience polls run on hundreds of premier websites, in addition to its own public polling site at www.civicscience.com. CivicScience’s InsightStore™ is used by leading enterprises in marketing research, advertising, media, financial services, and political polling. For more information, visit CivicScience by clicking here and follow them on Twitter – @CivicScience.