By Stacy Kerr, Matt McDonald, Elliot Owensby

A long-simmering disruption in higher education is boiling over as coronavirus upends campuses and budgets across the United States. For over a decade, the public has seen debates and discussions around a number of trends: more people pursuing degrees, increased tuition, increased debt, as well as on-campus debates that have occasionally spilled over to the public consciousness, including free speech controversies and social movements like Black Lives Matter and #MeToo.

As these issues have dominated public conversations around higher education, there are a set of underlying trends less familiar to the public, and even to policymakers, that have been driving real disruption at universities. These include reduced state funding on a per-pupil basis, increased prevalence of online education, changing demand for courses of study, long-term demographic shifts, and —perhaps most important—significant increases in financial aid and scholarship budgets.

The result of these competing forces are universities that are perceived by the public as institutions of strength, but in reality, face massive budget challenges and find themselves poorly positioned to weather the crisis brought on by the coronavirus pandemic. This dynamic is further complicated by a small group of elite institutions with large endowments that may be relatively more financially stable, but despite their hold on the public imagination are not actually representative of the higher education sector as a whole.

Rising tuition, rising aid

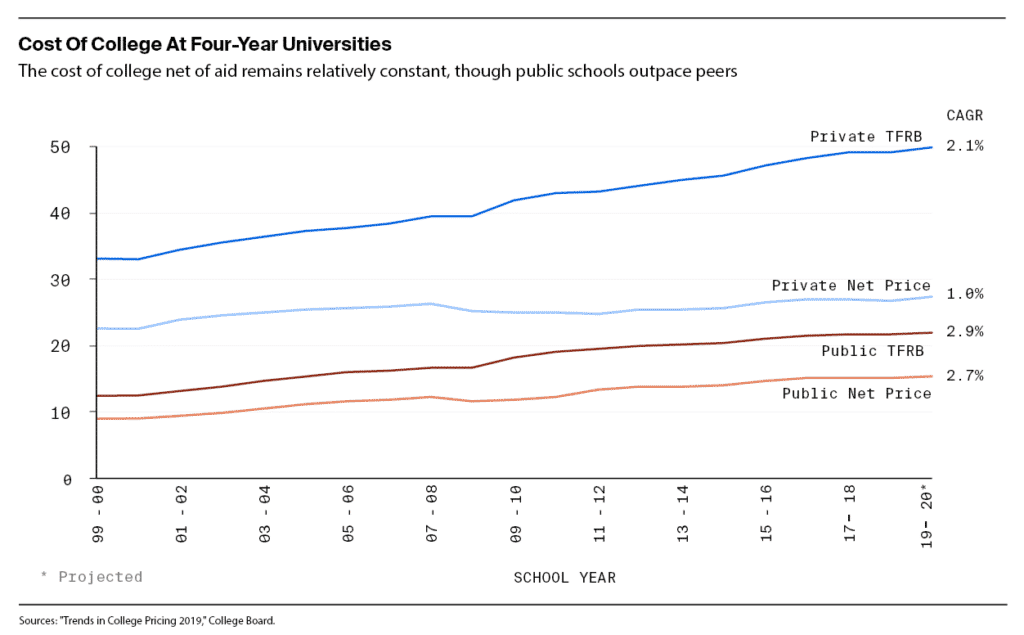

Everybody has seen the headlines of tuition increases over time. This is the sticker price, the published tuition and fees and room and board (TFRB), that regularly shocks generations of parents figuring out how to pay for college.

Less well understood are the aid and scholarship incentives that have become a regular part of the college shopping experience. For institutions themselves, this raises the question of “net price,” the average cost after the financial aid or scholarship discount is applied. As tuition has climbed, so too has the demand for discounts, and the reality has become such that an incremental dollar in tuition only raises a little over 50 cents in revenue for private four-year institutions.

When we look at this trend over the past 20 years, the average annual increase in net price at these institutions has been just one percent, in terms of a compound annual growth rate (CAGR)—lower than the rate of inflation over that same period. Behind this trend has been a more aggressive approach to figuring out how much a given family can and will pay. In practice, this means each student gets their own quote. So while the net price isn’t going up overall, families will experience this dynamic differently and may, or may not, be happy about it.

Endowment entanglements

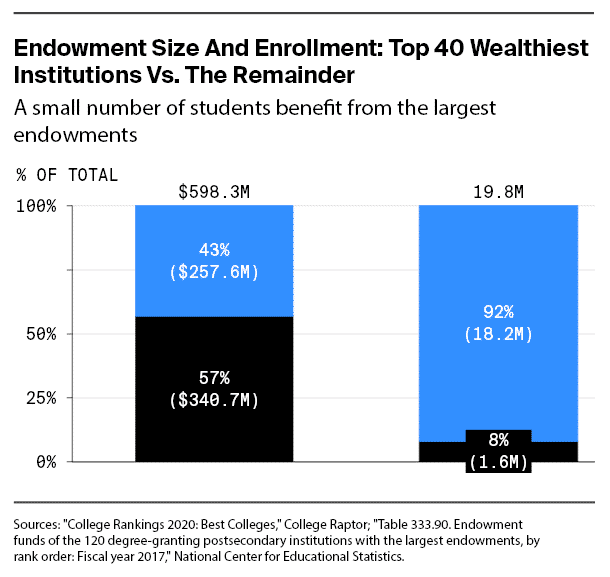

When the public isn’t getting sticker shock from tuition prices, they’re seeing eye-popping valuations for university endowments. Harvard’s endowment clocks in as the largest in the country at some $40 billion (undoubtedly smaller post-COVID crisis). But these headline-grabbing figures aren’t representative of the financial reality afflicting most campuses.

The 40 schools with the largest endowments account for 57 percent of all endowment assets but educate only 8 percent of all students pursuing four-year degrees. And for the universities fortunate enough to have these resources, endowments aren’t structured as rainy-day funds. Most were created from small gifts over time, with rules and stipulations tying them up in perpetuity. Some of these gifts fund areas of study that are declining in demand, which, given the tradition of tenure, make it even more difficult for universities to adapt to student demands.

Universities fortunate to have large endowments often face another wrinkle. As long as the university exists, the resources in the endowment, the same gifts stipulated for specific uses, must also serve as a type of rolling annuity with a consistent return that funds a significant portion of the annual budget to offset costs for students and families. Institutions with fewer resources utilize their endowment differently, and are often less dependent on the endowment itself for operating expenses. One 2016 analysis from the Commonwealth Fund found that the median university with an endowment under $25 million funded 1.8 percent of the operating budget with endowment resources; counterparts with endowments over $1 billion relied on endowments for nearly ten times that amount, or 17.8 percent of operating budgets.

Often the endowments serve to underwrite the cost of education, since the costs to the university are usually above even the tuition sticker price families are seeing. As the endowments lose value, their subsidy to university budgets naturally takes a hit. Even the portions of endowments with more financial flexibility face the challenge now of unwinding and selling investments at discounted rates.

Public challenges

Public universities are facing similar pressures for aid and scholarship, with the added complication of educating many more students at lower tuition rates. State budget pressures add an extra dimension of difficultly for public universities. For many public institutions, the decline in state and federal funding over past two decades means public support is a small share of the overall budget. Even in cases where budgets have been increased, the reality of larger numbers of students pursuing higher education means that budgets have been reliably declining on a per-student basis. Economic turmoil from the COVID-19 crisis will almost certainly mean declining tax receipts for state and local governments, exacerbating these downward trends in higher education funding and forcing difficult decisions on education priorities.

Many public universities have worked to supplement this decline in revenue with other sources, but those are similarly coming under pressure in the current environment. Foreign students who often pay full tuition to study in the United States may not have the ability to travel here for studies. Out of state students paying higher tuition rates may not be interested in paying top dollar if the university is conducting classes remotely.

Universities that run a hospital or rely on hospital revenues as a part of their operational budgets —a common model across research universities—similarly face budget pressures in the current environment. A bitter irony of this health crisis is that the decline in elective procedures and everyday medical care has gutted typical health services and sources of revenue.

Conclusion

No university wants to project an image of weakness. They want to be seen among their peers as building the best campus, attracting the best students, and hiring the best professors. Individually, this is the right strategy. But collectively they are a contributing to a broad misunderstanding of the underlying economics of higher education. The result is a sector that is poorly positioned to seek public support or family understanding at this time of urgent need.

An effort to improve understanding of the collective economic reality of universities is urgently needed to educate policymakers on the challenges ahead and to demystify the sector for the parents and students paying for what is still the best higher education system in the world.