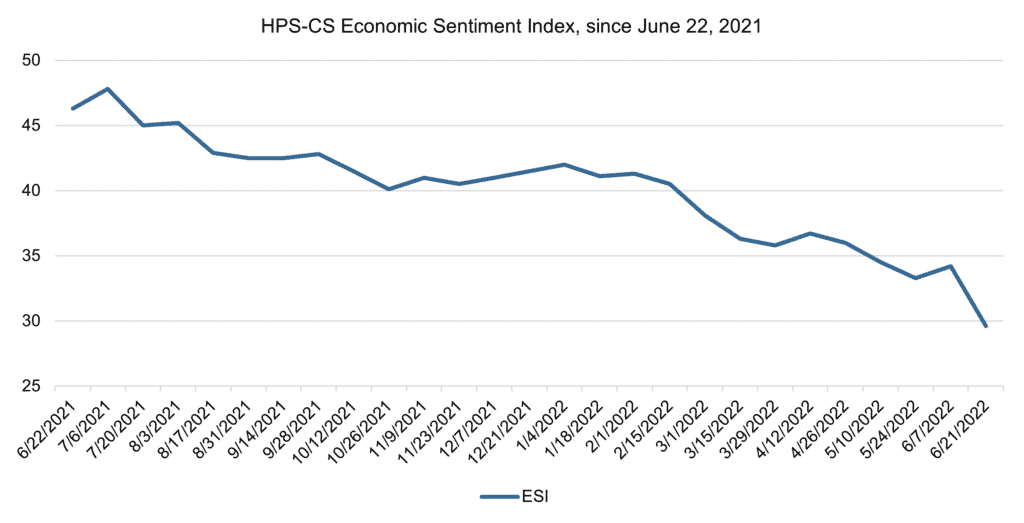

ESI: Economic Sentiment Falls, Following Downturn On Wall Street

Economic sentiment fell sharply over the past two weeks, dropping 4.6 points to 29.6. This is the largest two-week decline in the past year, and the lowest reading since the HPS-CivicScience Economic Sentiment Index (ESI) began measuring public sentiment about the U.S. economy in 2013.

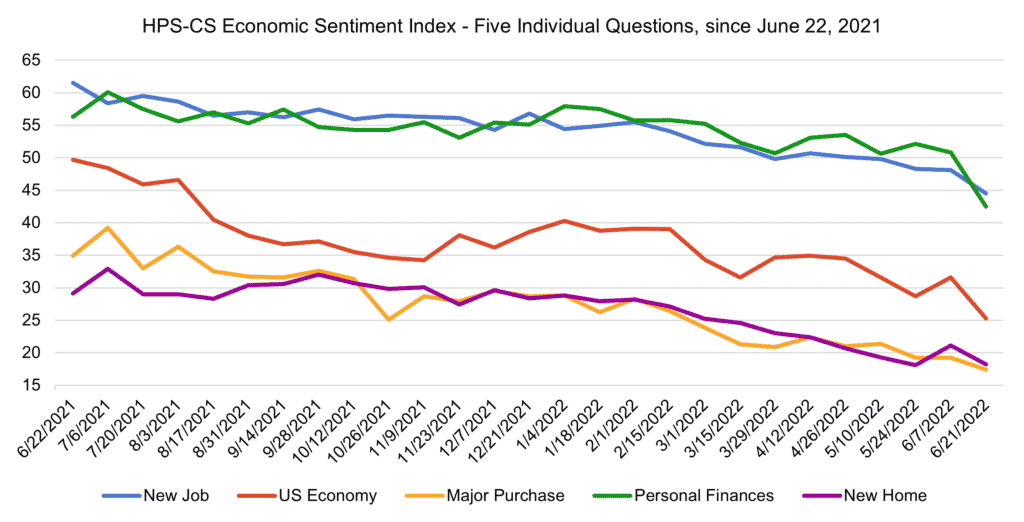

All five of the ESI’s indicators fell over the past two weeks. Confidence in personal finances fell the most—by 8.3 points—marking the first time in four months that the survey did not find it to be the highest indicator.

— Confidence in the overall U.S. economy fell 6.3 points to 25.3.

— Confidence in finding a new job fell 3.6 points to 44.5

— Confidence in buying a new home fell 2.9 points to 18.2.

— Confidence in making a major purchase fell 1.8 points to 17.4.

Weeks of speculation around the Fed’s decision to further tighten U.S. monetary policy by raising interest rates were confirmed last week, when Chair Jerome Powell announced an increase of 0.75%—the highest rate hike in nearly three decades.

The Fed’s decision came on the heels of a May inflation report showing the highest increase in consumer prices since 1981, up 8.6% in the past 12 months. Fuel prices have more than doubled in the past year, rising 106.7%, while food prices have shown a year-over-year price gain of 10.2%.

Housing costs, which determine around a third of the Consumer Price Index, increased 5.5%, the fastest 12-month increase in 31 years.

Surging inflation has contributed to a decline in purchasing power, with prices outgrowing incomes by 0.6% compared to April, and real wages declining 3% over the past year.

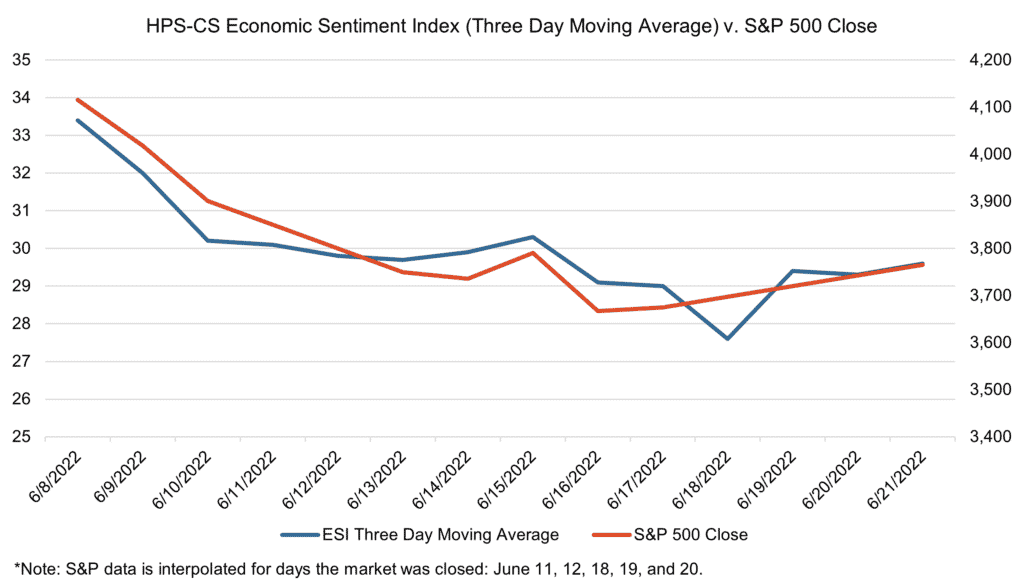

The ESI’s three-day moving average correlated significantly with stock market performance over the past two weeks. It began this two-week stretch at a high of 33.4 on June 8. It declined steadily to 27.6 on June 18, coinciding with the worst weekly decline of the S&P in two years. The ESI recovered slightly to close out the period at 29.6 on June 21.

The next release of the ESI will be Wednesday, July 6, 2022.