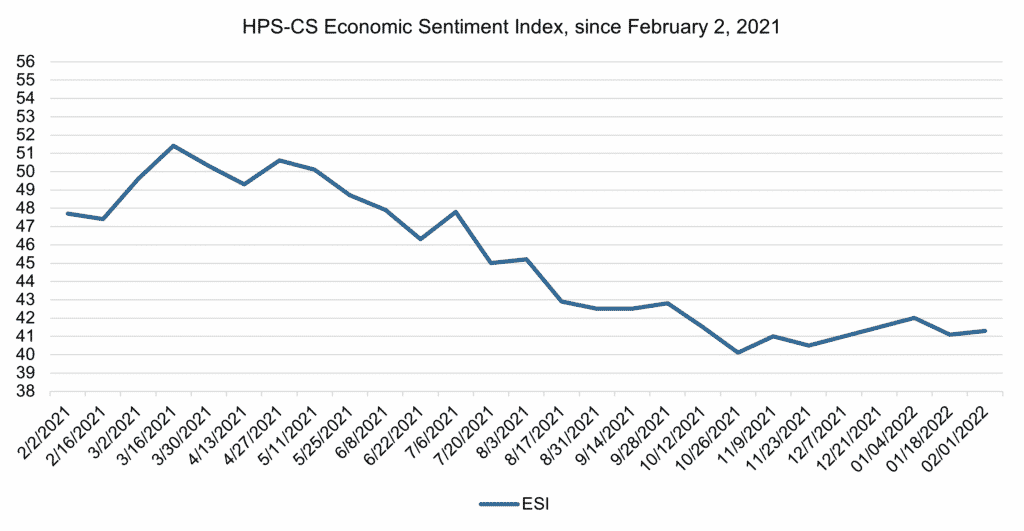

ESI: Economic Sentiment Rebounds Following Late January Spike

Economic sentiment improved slightly over the past two weeks, marking the fourth increase in the last five readings. The HPS-CivicScience Economic Sentiment Index (ESI) increased 1.7 points to 41.3, on the back of a substantial bump to close out January.

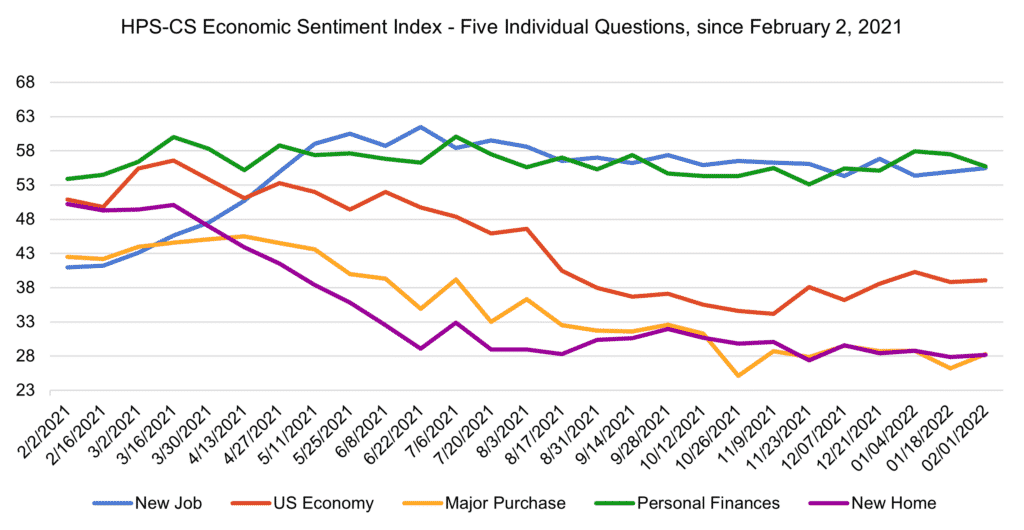

Four of the ESI’s five indicators fell over the past two weeks. The greatest decrease was in confidence in making a major purchase, which dropped 2.6 points to 26.6, followed by a 1.5 point drop to 38.8 in confidence in the Four of the ESI’s five indicators rose over the past two weeks. The greatest bump was to confidence in making a major purchase, which recovered 2.1 points to 28.3. This was balanced by a 1.8 point drop in confidence in personal finances, to 55.7. COVID case rates began to decline following an Four of the ESI’s five indicators rose over the past two weeks. The greatest bump was to confidence in making a major purchase, which recovered 2.1 points to 28.3. This was balanced by a 1.8 point drop in confidence in personal finances, to 55.7. COVID case rates began to decline following an Omicron-related spike around the holiday season, and businesses are responding by beginning to re-open their offices once again for in-person work. This closed out a month of heightened market volatility in January 2022, marking the stock market’s worst monthly performance since March 2020.

Here is how the ESI’s other indicators moved over the past two weeks:

– Confidence in finding a new job rose 0.6 points to 55.5

– Confidence in the overall U.S. economy rose 0.3 points to 39.1

– Confidence in the housing market rose 0.3 points to 28.2

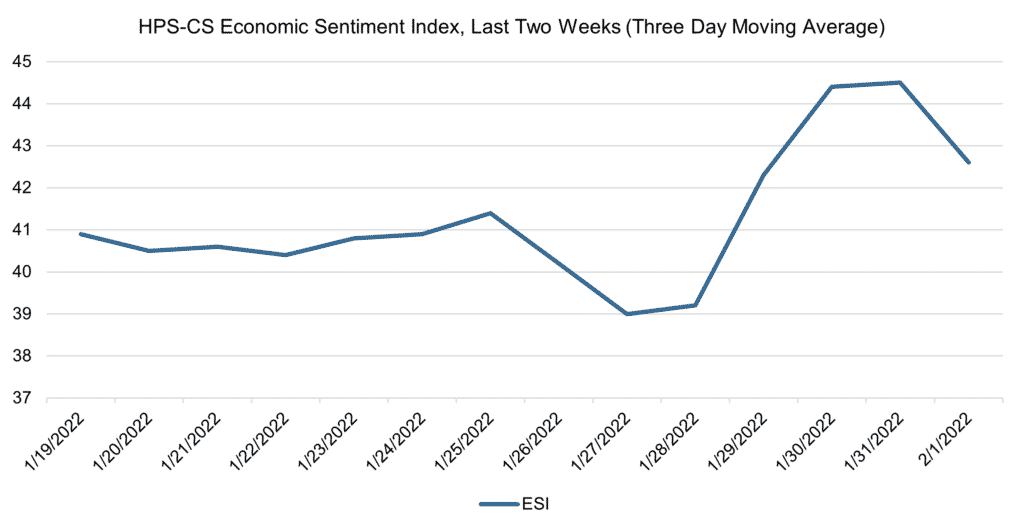

The ESI’s three-day moving average began this two-week stretch at 40.9 on January 19. It remained relatively consistent until January 28, at which point it rose 5.2 points within two days. The moving average fell slightly to end the period, closing out at 42.6 on February 1.

About the Index

The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures. For a more detailed overview of the Index and the underlying methodology, please request a white paper.

About CivicScience

CivicScience, Inc. provides the leading intelligent polling and real-time consumer insights platform, the InsightStore™. Its proprietary platform powers the world’s opinions and quickly gets that data to the decision makers who care. Every day, CivicScience polls ask millions of people questions related to thousands of topics, while its powerful data science and big data technology analyzes current consumer opinions, discovers trends as they start, and accurately predicts future behaviors and market outcomes. CivicScience polls run on hundreds of premier websites, in addition to its own public polling site at www.civicscience.com. CivicScience’s InsightStore™ is used by leading enterprises in marketing research, advertising, media, financial services, and political polling. For more information, visit CivicScience by clicking here and follow them on Twitter – @CivicScience.