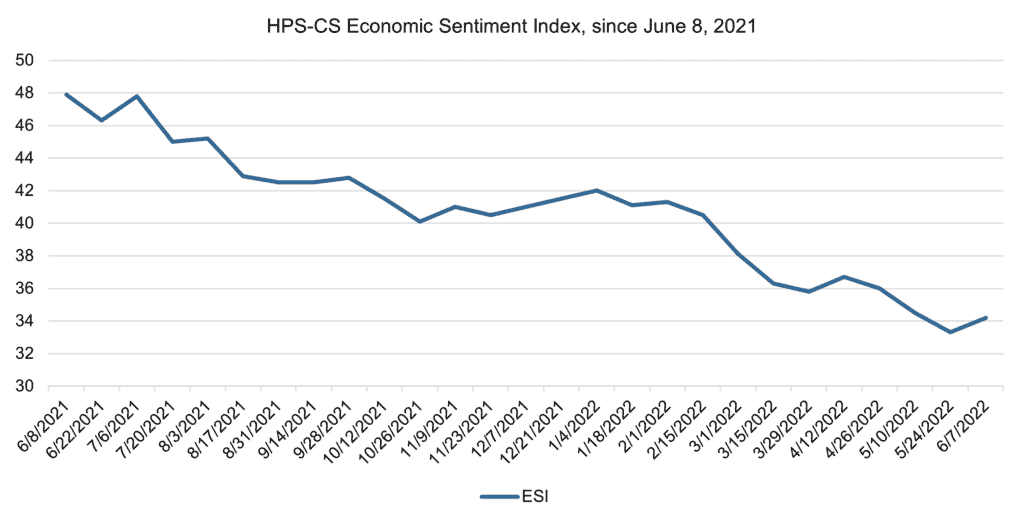

ESI: Economic Sentiment Improves After Six Week Period of Decline

Economic sentiment recovered slightly over the past two weeks, following six straight weeks of decline. The HPS-CivicScience Economic Sentiment Index (ESI) rose 0.9 points to 34.2, largely driven by confidence in the housing market and the health of the U.S. economy overall.

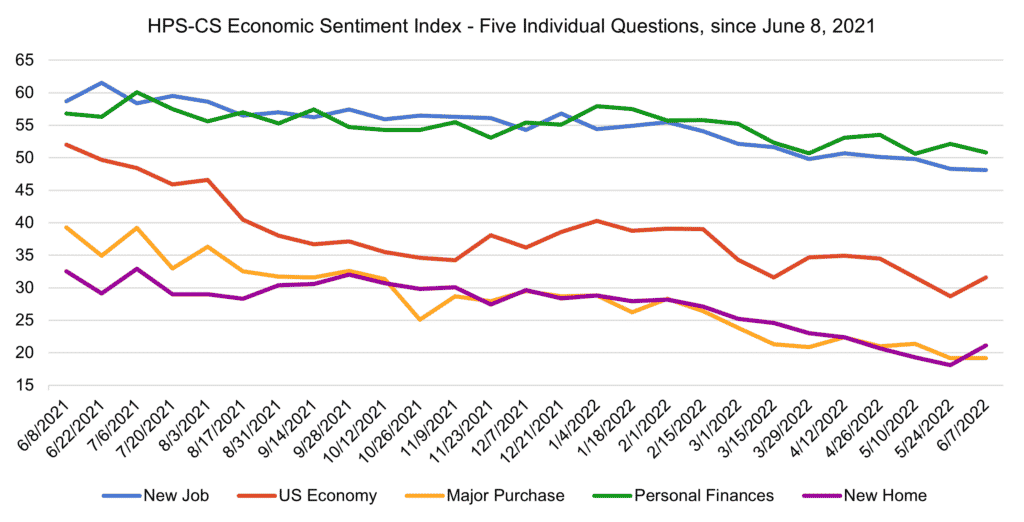

While the aggregated index rose, only two of the ESI’s five indicators measuring the public’s sentiment about different areas of the economy increased. Confidence in purchasing a new home rose 3.0 points to 21.1, while confidence in the U.S. economy rose 2.9 points to 31.6.

— Confidence in making a major purchase remained steady at 19.2.

— Confidence in finding a new job fell 0.2 points to 48.1.

— Confidence in personal finances fell 1.3 points to 50.8.

Confidence in personal finances and finding a new job remained the highest indicators of confidence, continuing a trend of consumers feeling better about their own personal situation compared to the rest of the economy.

The past two weeks marked a tone shift in public statements from business leaders about the economic outlook for the remainder of 2022. JPMorgan Chase CEO Jamie Dimon said the largest U.S. bank is preparing for an economic “hurricane.” Retail stocks slumped following Target issued a warning that profit margins are likely to further decline due to a supply glut going into the summer. And Tesla CEO Elon Musk said he has a “super bad” feeling about the economy, predicting the electric car company may have to cut 10% of U.S. jobs.

Despite these gloomy predictions, the U.S. job market has remained strong, with 11.4 job openings as of April 29. Senior economist David Tinsley from the Bank of America Institute said incomes increased by 9.2%, a rate higher than the current inflation of 8.4%. This has largely been attributed to a recovery in service sector jobs, as the U.S. enters its first full summer without COVID restrictions since 2019.

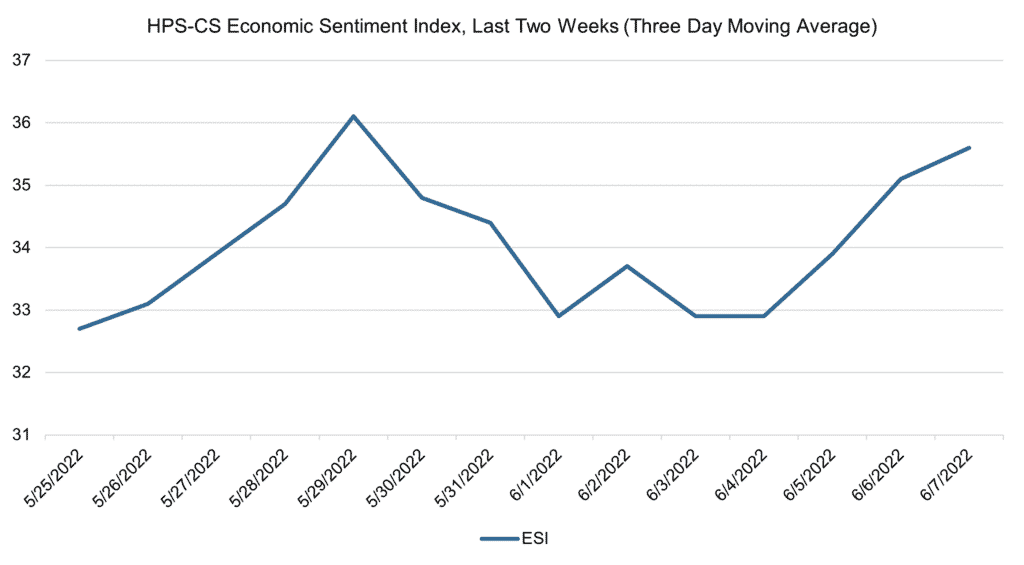

The ESI’s three-day moving average began this two-week stretch at 32.7 on May 25. It hit its two-week high of 36.1 on Sunday, May 29. The moving average settled at a low of 32.9 for June 3 and 4, before rebounding to 35.6 to close out the session on June 7.

The next release of the ESI will be Wednesday, June 22, 2022.