ESI: Economic Sentiment Falters, Driven By Concerns Over Housing Affordability

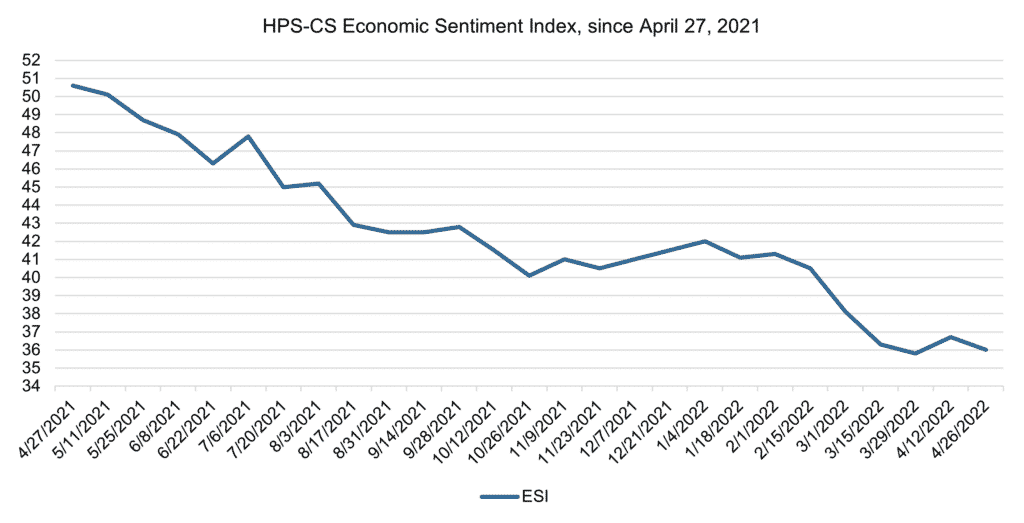

Economic sentiment fell over the last two weeks, marking the fifth decline out of the last six readings. The HPS-CivicScience Economic Sentiment Index (ESI) decreased 0.7 points to 36.0.

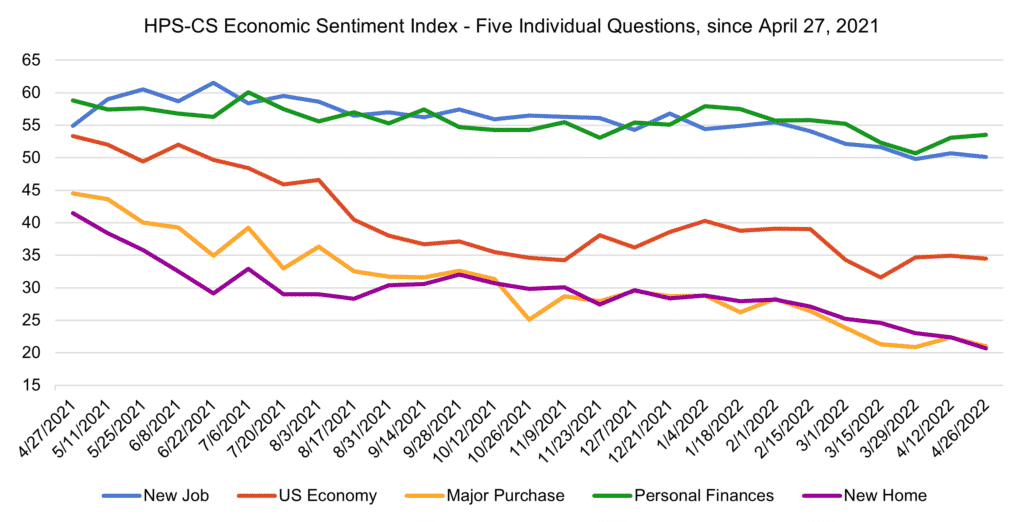

All but one of the ESI’s five indicators decreased this week. Confidence in buying a new home declined the most, falling 1.7 points to 20.7, a new record low.

– Confidence in making a major purchase fell 1.4 points to 21.0.

– Confidence in finding a new job fell 0.6 points to 50.1.

– Confidence in the U.S. economy fell 0.4 points to 34.5.

The only indicator to improve was confidence in personal finances, which rose 0.4 points to 53.5.

Last week, Goldman Sachs analysts raised their projected probability of recession to 15% in the next 12 months and 35% within the next 24 months. The heightened risk is attributed to expectations that the Fed will further raise interest rates as a means of reining in inflation and cooling the economy.

New data released this week showed average national home prices reached an all time high in February, increasing 19.8% year over year. Fortune reported last week that homebuyers paid 20% more for a standard 30-year mortgage than homebuyers in January and 38% more than a year ago.

Homebuyers are flocking to smaller cities with lower costs of living, a sign that housing affordability is becoming a higher priority. The Rapid City, South Dakota metro area ranked highest in the Wall Street Journal’s emerging housing markets index for Q1 2022.

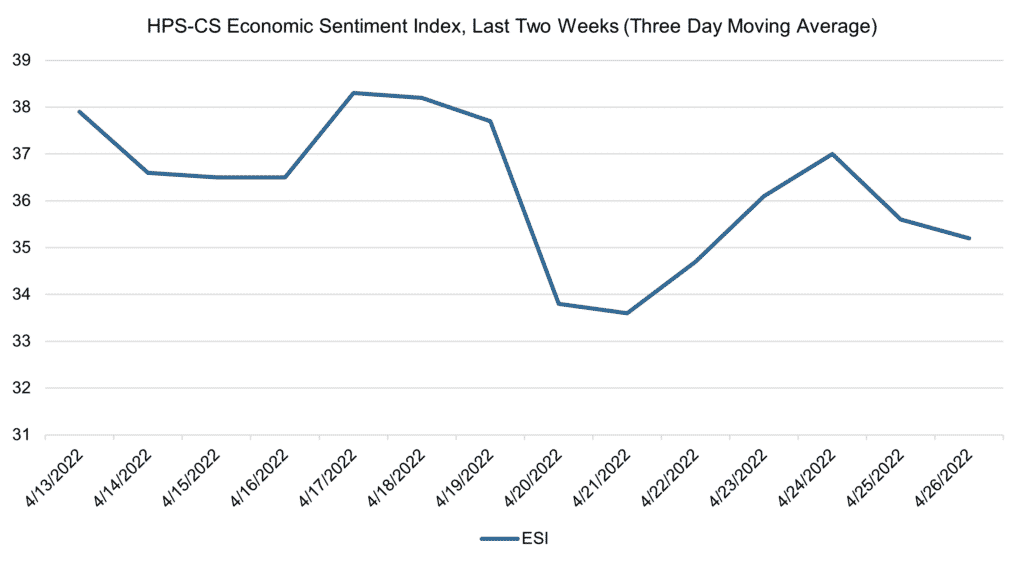

The ESI’s three-day moving average began this two-week stretch at 37.9 on April 13. It hit its two-week high of 38.3 on April 17, its low of 33.6 on April 21, and closed the session at 35.2 on April 26.

About the Index

The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures. For a more detailed overview of the Index and the underlying methodology, please request a white paper.

About CivicScience

CivicScience, Inc. provides the leading intelligent polling and real-time consumer insights platform, the InsightStore™. Its proprietary platform powers the world’s opinions and quickly gets that data to the decision makers who care. Every day, CivicScience polls ask millions of people questions related to thousands of topics, while its powerful data science and big data technology analyzes current consumer opinions, discovers trends as they start, and accurately predicts future behaviors and market outcomes. CivicScience polls run on hundreds of premier websites, in addition to its own public polling site at www.civicscience.com. CivicScience’s InsightStore™ is used by leading enterprises in marketing research, advertising, media, financial services, and political polling. For more information, visit CivicScience by clicking here and follow them on Twitter – @CivicScience.